Nobody probably argued with Katherine Paine when she observed, “The moment you make a mistake in pricing, you’re eating into your reputation or your profits.” This is a matter of common sense. Right? Wrong.

In B2B business, Pricing has always been a sticky subject, be it product or service.

“What is the right price?” “How should we price our offering?” “What should be our discount structure?” These are some of the questions that have troubled the senior management over the years.

Despite significant development in research & analytics, Pricing still remains an area of circumstantial compulsion and conjectural expediency. Can it be better? Well, yes.

Let us show you how to blend the art and science of Pricing to maximize both your reputation and profit.

To succeed in B2B Sales with the right Price, one must assimilate the two cardinal principles:

- People buy from People

- People want to “buy”. They don’t like to be “sold”

Just like ordinary consumers, B2B Buyers are individuals. But they operate in a business set up – within the ambit of certain policy and compliance guidelines.

Interestingly, the psychology that drives the Buyer is similar in both B2B and B2C cases. Sounds absurd? Well, it is not.

Let’s pause for a moment and take a deep breath.

So, what drives a Buyer? You may ask “B2B or B2C?”. Well, it doesn’t matter. In either case, the Buyer is driven by certain Stated, Implied and Dormant needs. The chance of closing the deal is proportionate to the Seller’s understanding of all three needs, irrespective of B2B or B2C. Price is important, but not necessarily the sole criterion for selection.

Let us delve a bit deeper.

In a buying situation, the B2B Buyer is likely to consider some or all the following

- Selection (various options)

- Personalization

- Convenience (of purchase, usage and disposal)

- Savings

- Benefits (technical, functional, financial, emotional).

Wait a minute. Don’t we all consider the above while buying a cell phone or a vacation package? Hey, aren’t these B2C products? Well, this is exactly the point.

Be it B2B or B2C, the buying drivers and decision considerations pivot around similar parameters. Yes, there are differences too. But I guess you already know them (for example: the budgeting process, approval mechanism, legal contracting and a few more).

The level of sophistication and maturity for assessing the available options (and finally arriving at a purchase decision) may vary from company to company.

Given the above context, how does the Seller arrive at the right Price that protects its reputation, communicates Value and ensures profitability?

Right from the dawn of the industrial age, Sellers have adopted the straight forward Cost + Profit model to arrive at the Price. It stays the same for many companies, even today.

Over the last few decades, several forward-thinking companies have moved to Value-based pricing. It certainly sounds great as a principle. But in practice, most Sellers wouldn’t hesitate to bend backwards, offer preposterous discounts to beat competition and close the deal.

Such discounts are often at the discretion of the top management and are mostly decided arbitrarily, based on the situation in hand. Over a period of time, such practices erode the credibility of the Price the company quotes, dents the company’s reputation and dilutes profits. Furthermore, it sets a vicious cycle of wrong expectations with the customers.

So, what should we do? For arriving at the right Price in B2B business the Seller must be clear about the following 3 points:

- Ceiling Price – The maximum price that its offerings may hold in the target market due to differentiated Value

- Competitive Price – The average price of offerings which the target customers are likely to compare with

- Reserve Price – The Price at which the Seller will walk away from the deal.

For every offering, the above 3 Prices should be standardized across the Seller’s organization and updated periodically depending on research and market realities.

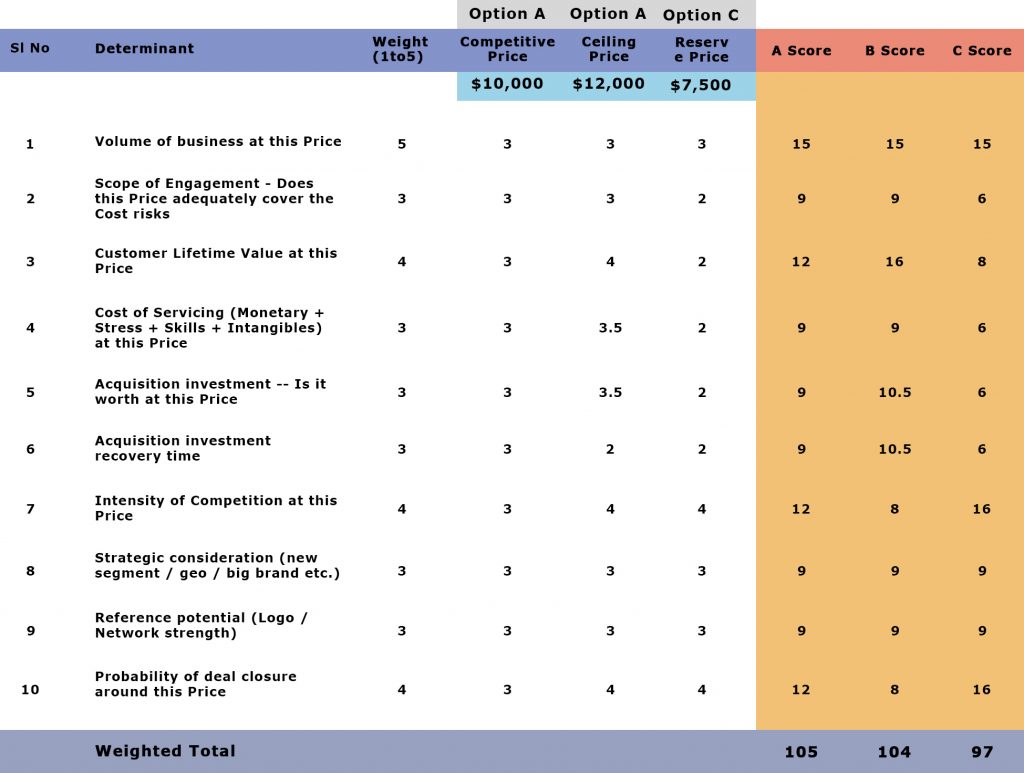

In a selling situation, these 3 prices must be judged against the 10 primary determinants, with weights assigned to each of this. Principle of Pugh matrix should be used to compute the weighted score for each of the 3 prices, against each of the determinant.

Finally, the weighted total score is calculated for each of the 3 price options. The one with the highest score should be adopted for the selling situation in hand.

An example of the Price Determinant table is furnished below:

In the above example, the Weights are assigned to the different determinants, based on the selling situation. (From one selling situation to the next, the Determinants will remain the same, but the weights need to be assigned afresh every time, as the situation may vary.)

For Competitive Price, a standard rating of 3 is assigned against each determinant. For Ceiling Price and Reserve Price, the rating is compared with respect to the Competitive Price and a relative rating (on a scale of 1 to 5) is entered. For example, the Customer Lifetime Value is higher for Ceiling Price than that of Competitive Price. So, the rating is 4 for Ceiling Price against 3 for Competitive Price. But Customer Lifetime Value is lower for Reserve Price, when compared to that for the Competitive Price. So, the rating is 2.

All the relative ratings are thus entered. Each relative rating is multiplied by the corresponding weight and the score for each of the 3 Price options is arrived.

The right price which the Seller should quote is the option which has the highest Weighted Total score. In the above example, it is Option A (Competitive Price). However, Weighted Total score of the Ceiling Price also comes close. So, the final price of the offering should be between Ceiling Price and Competitive Price.

The Seller may run a couple of iterations with different values around the Ceiling, Competitive and Reserve Prices and arrive at the final Price to be quoted to the target customer segment for that Offering.

For any offering, the absolute value of the Price quoted should be the similar, irrespective of the size of the customer.

For serving diverse customer segments, it is better to create different Offering variants with different Price points, rather than quoting widely divergent Prices to different customer segments, for the same Offering.

A final word. The above Pricing mechanism must not be confused with Discounting. For B2B business, a Seller may use Discounts as a negotiation tool and an enabler to close the deal on time. And like Price, Discounting is also a blend of science and art. But that’s a whole new chapter altogether. We will discuss it another day.

As for now, this write-up offers some insight into how to arrive at a Price for your offering without compromising your reputation, value and profit.

About The Author: Aurijit Ganguli

Aurijit is a senior business leader with over 28 years of experience in multinational and cross-cultural business environments. He achieved consistent success in Demand generation, Revenue & Profit growth for the IT industry in North America, Europe and India

More posts by Aurijit Ganguli